While investing in commodities is inevitable for most investors, here we take a look at how gold performs in comparison to other commodities both in the short and long run to help

Gold is a reliable store of value

From salt to tobacco to seashells, all kinds of soft agricultural commodities have been used as currencies at some point in history. But over time, the use of these soft commodities came to a halt for a variety of reasons:

- They were only grown in certain markets or geographies, making them hard to trade. For example, Tobacco was not grown in all parts of USA

- They could not retain value when moved from one region to another. For example, salt could not be used in parts of Africa where it rained. Even today, for example, oil production is geographically more concentrated in certain regions of the world; for example, more than 50% of proven reserves of oil are currently located in the Middle East.

- Using them as currencies would take them away from their primary use i.e. human consumption

After these soft commodities, metals began to be used as currency. Copper, iron and silver were in circulation across different parts of the world. However, these metals too fell short because of similar reasons:

- A metal like silver or copper, for example, has several industrial uses, so using it as a currency takes it away from its primary use

- All metals other than gold lose value over time because they tarnish or rust

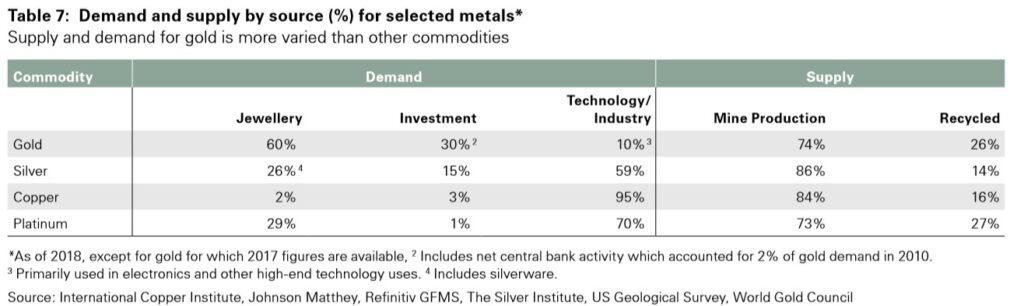

While gold too is superior by virtue of being a more malleable and ductile metal that is also a great conductor of electricity, it is too valuable, expensive and rare to be used industrially. Additionally, gold is chemically inert meaning it does not tarnish over time and retains its lustre and shine. Thus, because gold is almost indestructible, all the gold that has ever been mined still exists in one form or another. While other metals are unable to absorb shocks and shortages in primary production, recycled gold comprises a larger share of supply than for any other metal.

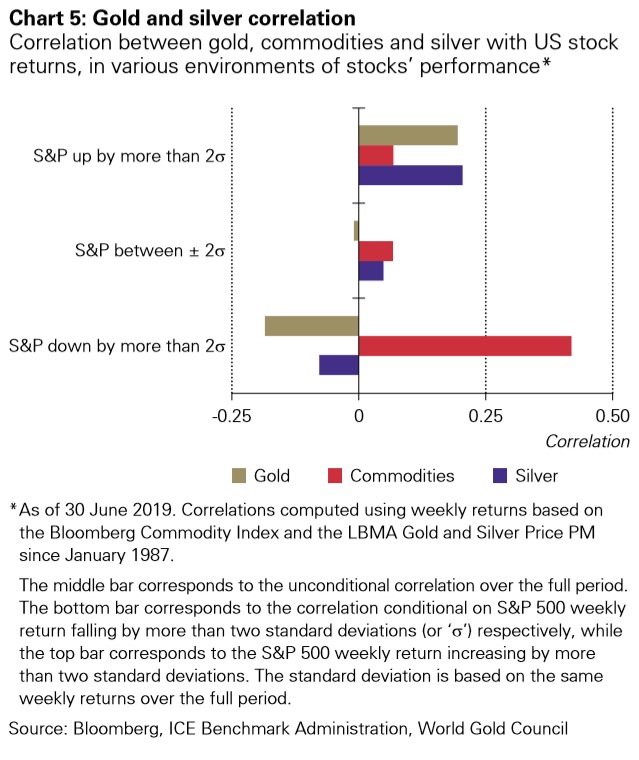

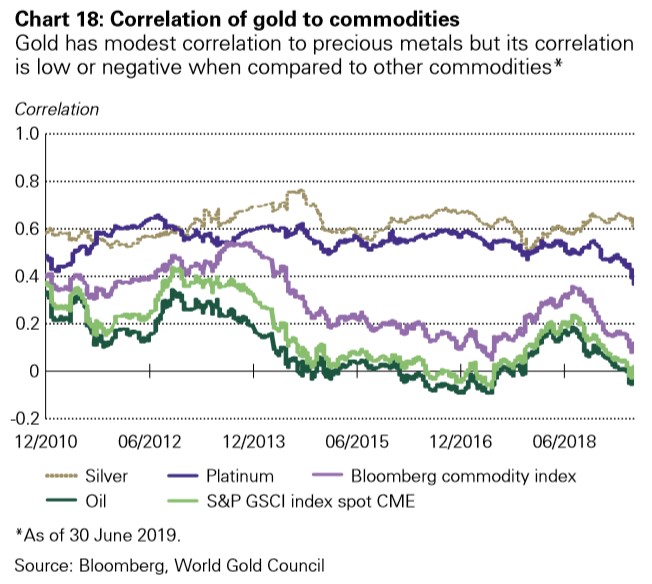

As a result, gold is also a much more effective portfolio diversifier than other precious metals like silver and platinum. When the market is doing well, gold and these other metals perform well, and their correlation is positive. But when the market takes a downward turn, the performance of metals like silver and platinum suffers because their demand depends largely on industrial demand.

Gold, with such few industrial uses, has no such issues, so its value persists even when the market is down.

Due to these reasons, it made sense that gold played the role of a currency anchor till 1971, when the US, and the world, moved past the gold standard to paper money. But even today, gold continues to play a major role in determining a country’s wealth in the form of gold reserves, which are increasing year on year. In 2018 alone, central banks purchased more gold than at any time since the end of the gold standard – and that trend continued through the first half of 2019.