At MSE we know how daunting buying your first home can be, and the already big hurdles that come with homebuying have only been raised higher by the disruption caused by coronavirus and the resultant lockdown.

In this blog, we (MSE Katie, Kit, Molly, Holly and Becky) – who are all at various stages of the homebuying process – have put our heads together to lend you (see what we did there?) some of our hard-earned knowledge about getting on the first rung of the property ladder during a pandemic. We hope everything here helps you decide whether buying a home is right for you now, and, if it is, how best to avoid heartbreak and frustration.

Even with (dare we say it ourselves) above-average expertise and insider knowledge on our side, the market has been vastly different compared to normal times. Here’s everything we’ve learned along the way… and stuff we wish somebody else had told us too!

1. Before you start house-hunting, CHECK if you can realistically get a mortgage – it’s a whole new world for homebuyers out there

In normal times, first-time buyers usually take their first steps on to the property ladder with a smallish deposit, usually 10%, or sometimes even 5%. But as the pandemic’s put pressure on banks, the mortgage market has shrunk massively, with our much-needed 90% and 95% mortgages in short supply. It’s meant significantly fewer mortgage options – if any – for most first-time buyers with lower deposits.

It’s worth considering what property value you could afford if your deposit had to now be worth 15% or even 20% of its price. If you could be happy in what would likely be a smaller property, or in a different area, it’s worth considering as this will likely give you more mortgage options to choose from.

MSE Katie experience a lack of willing mortgage lenders:

” When we applied for our mortgage, there was one single lender who was offering 90% loan-to-value. Living in commuting distance of MSE Towers in London meant that we couldn’t stretch to a bigger deposit and still have the kind of property we wanted. Sure enough, a week after we applied, that lender withdrew its 90% mortgages from the market – we were so lucky to get in before.”

A good place to start is our Mortgage Best-Buys tool, which will give you an initial look at the market – and show you if there are actually any products available for your situation.

Remember. A good mortgage broker can be worth their weight in gold to help here too.

As the mortgage market moves so quickly in this pandemic, a mortgage broker will guide you through all the options and the lending process, which is especially helpful for a first-timer. They have access to the latest information about deals you might be able to get and how much you can borrow – plus they can help you plan for the future if it’s just not possible for you to get a mortgage right now.

For many brokers, you don’t have to pay a fee and you can get an initial assessment without committing – though make sure you ask them about their fees upfront just in case. While some brokers do charge, many make their money on commission from your lender once they arrange a mortgage for you.

2. Get a mortgage agreement in principle and reduce the risk of being let down later

Because the pandemic has left fewer options for first-time buyers, your word alone won’t be enough to prove to a seller you’ll get a mortgage. So it’s wise to get a mortgage agreement in principle (AIP) from a lender – in fact, many estate agents and sellers won’t consider you a serious buyer without one. It at least gives some indication that a lender will lend to you (though remember, an AIP is not binding).

MSE Kit found this when he was looking at properties:

” The seller of the property I am buying wouldn’t even allow viewings without an agreement in principle – so it’s a good job we got one when we did!”

MSE Katie added:

” Having a mortgage agreement in principle ready to go not only helped me to clinch the offer with the seller, it also meant it was much quicker and easier to start the ball rolling with a formal mortgage application. It also saved me a lot of heartache – other properties I missed out on are now back on the market, showing just how likely it is that buyers are struggling to get the mortgage they need.”

3. If you’ve been furloughed or work in an at-risk sector, you’ll need proof, ie, a letter, to show that your job is safe

If you’ve returned to work from furlough, and have at some point received 80% of your normal salary, lenders will need to be certain of your full income going forward. Some will ask you to get a letter from your company which states that you’ve been brought back from furlough, on what date, and crucially, what your normal salary will be from now on. This will likely be mandatory in order for the lender to approve your loan, especially if your most recent bank statements show reduced income.

MSE Katie had to get one of these as part of her and her partner’s mortgage application:

” My partner was on furlough for two months during the pandemic. Our mortgage lender needed to see copies of our bank statements – so he was asked to provide his return-from-furlough letter to prove his lower salary payment was not usual.

The original letter from his employer didn’t include his salary – the most important part. We were lucky, he works for a large company and it was sorted within hours. But for some, this could take days or weeks to request from HR. This turned out to be a really important document, so it’s easier to ask for it before you even apply.”

This has another benefit while house-hunting – having documentation like this proves to the estate agent that your job is no longer at risk and you are less likely to be turned down for a mortgage.

If you’re working in an industry that’s more unstable in the pandemic, like the travel industry, it’s best to be upfront and tell your mortgage broker this, in case there are any restrictions on lending. This will save you being let down further along in the process and will help the broker to give you a true picture of the mortgages you may be able to get.

4. Don’t rush just to beat the coronavirus stamp duty holiday – most first-time buyers don’t pay stamp duty anyway

There’s been a lot of talk about the stamp duty threshold being increased to £500,000, and this has seemingly contributed to a mini property boom – according to property website Rightmove, more than £37 billion worth of property sales were agreed in July, the busiest month for 10 years.

But while this change is great, don’t let this be THE reason you decide to buy, or let it unnecessarily rush you if you are in two minds. That’s because most first-time buyers don’t pay stamp duty anyway.

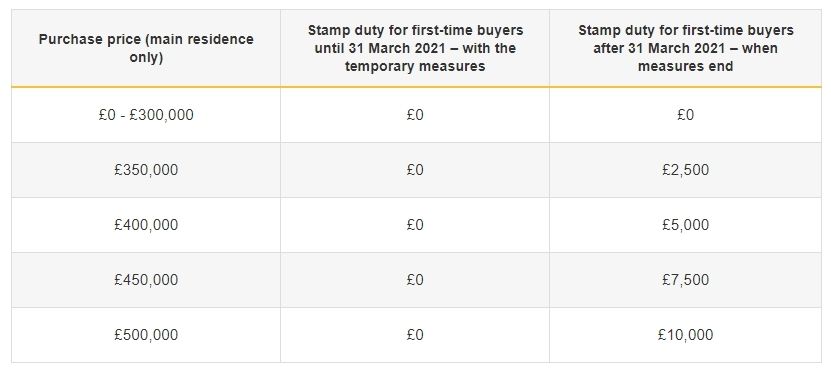

Under normal stamp duty rates (which kick back in from April 2021), first-time buyers pay zero stamp duty on the first £300,000 of a property’s sale value (as shown in the table below). They then pay 5% of the portion from £300,001 to £500,000. After that, normal rates apply.

According to Zoopla, the average cost of a home for a first-time buyer is £220,000 – so the majority of us are buying well within that tax-free limit.

On a lesser point, the stamp duty holiday appears to be inflating some house prices – which, if it’s the case with a property you’re interested in, might wipe out the benefit you gain from the stamp duty holiday in the first place.

If you are already in the process of buying, completing during the stamp duty holiday may help some buying higher-value homes claw back a bit of extra cash AND be attractive to your seller, as they might have an interest in taking advantage of the stamp duty holiday too. Which brings us on to this…

5. Do your research and gather your paperwork – always important

After lockdown, many sellers are looking for quick moves. Here’s how to be an ‘attractive’ buyer…

Many people are looking to move before the coronavirus stamp duty relief deadline, which has made the market extremely competitive. While all offers must be put to the seller, estate agents will also be looking out for their sellers’ best interests and will make recommendations to make a quick sale and minimise the chances of it falling through.

Russell Quirk of estate agency Keller Williams said: “Buyer position is as important as the money you offer.” This is true in general, but is especially important for sellers looking to take advantage of stamp duty relief.

We asked Quirk, and Claire Comerford of Townends Twickenham, what makes a first-time buyer a good bet for these sellers:

- Demonstrate that you are ‘ready, willing and able’. For first-time buyers, this could mean proving you have no chain ‘below’ you, which might stop the sale completing before stamp duty relief ends. Comerford says: “Lenders are constantly moving the gate posts right now – gifts from parents, for example, are now largely not acceptable as a deposit. So if you have an AIP from three months ago, you may need to get a new one. If you are renting and need to give notice, or if your funds need notice to be released, then disclose this at the time of the offer.”

- Don’t make a big deal out of small, easily-fixable issues. This enables the agent to show the seller that you are less likely to hardball negotiations over something relatively insignificant.

- Show commitment to the property. Comerford says: “It should be ‘the one’, not the best of a bad bunch, and agents will need reassurance that you won’t pull out when something better comes along.”

- Finally, be nice. Quirk says: “Strike up a good rapport with the selling agent and it’ll go a long way. It helps for them to show the seller you’ll be easy to communicate with.”

7. Savings stretched after coronavirus? Here’s the nifty way MSE Becky nabbed a bargain

MSE Becky managed to get £25,000 less (yes, really!) than the asking price on her home:

” As soon as I’d worked out my budget and the location of where I wanted to buy, I set out to find a bargain.

I used every property search website and spotted a place with non-professional photos (slightly off-putting) that’d been on the market for six months, reduced by £10k from its original price. This suggested to me they’d be open to consider an offer.

After viewing, I made a gutsy move the same day, rang the agent and offered a further £15k less, and even though I was expecting them to meet me in the middle, they’d accepted within minutes! It was then I knew I owed it to them to make it a quick sale, so I did everything I could to prevent any further delays.”

Here’s how MSE Becky bagged a bargain building:

- Figure out your costs (including solicitor and other fees) and set yourself a limit.

- When searching for a home online, set the price range higher than your limit (£10-20k max).

- Don’t be a postcode snob – it really doesn’t matter provided you’re happy with the property.

- Sort the order of the search results to ‘cheapest first’ not ‘newest first’. Even if some properties have been on the market for a while, there’s no harm viewing them as there could be all sorts of reasons why they’ve not been snapped up (Becky’s seller’s reason was the pandemic).

- Keep an eye out for ‘reduced’ homes as they’re likely to be looking for a quick sale.

- Don’t be put off if the images aren’t that great – at least it shows what the property is really like.

- Don’t be keen at the viewing – poker face for a cheaper place (tip from MSE Becky’s mum)! Remember, this tip only applies if you know there’s little competition, otherwise don’t hesitate to show your interest and put in an offer, as some properties can sell within hours of a viewing.

- Be bold and offer a price below what you can afford.

- Be prepared to negotiate if they don’t accept your first offer.

- If accepted, act fast and get that paperwork in as soon as possible, so it’s a quick and easy sale.

MSE Money Editor Jo, who’s currently looking to move house, also suggests that your bargaining position might be stronger if any of the following apply to the property:

- It’s on a busy road.

- It’s above a commercial premises.

- It needs renovation.

- It has a small living space and/or small bedroom.

- It’s more than 15 minutes from a station.

- It has no period features.

- It has a short lease (95 years or less).

However, with all of this, do be careful about what you’re buying – and if it needs work, don’t underestimate the costs. For example, if it needs a new kitchen or bathroom, you can easily spend £5,000 to £10,000 on that. You want something you can live with, at least in the short term, while you save up for the costs of renovation.

8. Prepare for an exercise in PATIENCE waiting for your mortgage offer – the pandemic’s caused some big backlogs at banks

In normal circumstances, you’ll usually be able to get a mortgage offer approved by a lender within three to four weeks.

But currently you need to add delays and backlogs caused by coronavirus to that, so you might find you’re waiting nearer to 40 days to get your formal mortgage offer (and sometimes even longer than that).

This can be really, really stressful, both for buyer and seller. Once you’ve had your property offer accepted, neither wants the deal being scuppered by the mortgage application. So be prepared to stretch your patience levels (and hope the seller’s feeling patient too).

MSE Kit had a long delay:

” It took well over a month for HSBC to approve our mortgage. Our patience quickly frayed, particularly when we received messages from the seller asking why it was taking so long. We were at the mercy of HSBC, but what we found did help was to keep a line of communication open with the seller. We’d send a message once a week to update her about where HSBC were at in the process, and to reassure her that everything was in hand (which, we think, really helped!).

Also, keep your documents to hand. We submitted our mortgage application and then went on holiday (it was a staycation), but soon found out that HSBC required a new copy of our passports. Of course, we had to wait until we got home to send these, which only added to the delay in getting the mortgage approved.”

9. Don’t be afraid to CHASE your solicitor – even during a pandemic! After all, you are paying…

It’s not unusual for solicitors to work at their own pace. This might feel especially the case during a global pandemic and lockdown, where some legal firms or mortgage brokers might not be working from the office or may even have reduced staff.

Sometimes it can take ages for the legal side of things to get done, which can throw up issues or cause panic, but don’t feel reluctant or embarrassed about chasing, either by phone or email – after all, you’re paying them £100s or even £1,000s to work for you!

MSE Kit had issues with his solicitor due to the coronavirus:

” We’d totally expected our solicitors to work at a walking pace, which is fine, so long as the work got done. When a few of our emails went unanswered, we decided to call them. Turns out that our point of contact had been furloughed, and that our emails were just going into an empty void.

That phone call got things going again, thankfully. And on other occasions where we’d gone a week or so without hearing, we’d give them another call – and a few hours later, we’d get a notification that X had been completed. It’s amazing what a difference a friendly phone call can make! It also just gave us the reassurance that the solicitors were doing what we needed them to, rather than fretting every day and refreshing our email every half hour.”

MSE Holly added:

” We didn’t hear back from the mortgage adviser on things that we felt were crucial (such as stamp duty changes), which left us anxious. We persisted by email and phone to make sure our query wasn’t lost. Ultimately, it’s likely the biggest financial commitment you’ll ever make, so you do have a right to get a reply to questions you have.”

10. ‘I had to do pretty much ALL my homebuying process online due to the pandemic’ – being organised with admin really helped

MSE Molly completed her house purchase without having to see anybody face to face, and with barely a phone call made. Here are her top tips if you’re doing most of the process online:

” If there are two of you, make a dedicated joint email account you’ll both remember to use and check regularly. I wish I’d done this sooner, as it was the first thing I did when we moved in because we then applied that logic for our bills.

Be short and snappy with your emails – lists or bullet points of things you need checked out work well. Print out those conversations and keep them in a dedicated folder. We split ours into four sections – ‘To-Do ASAP’ at the front, then once complete, filed into either ‘Mortgage’, ‘Solicitors’ or ‘Estate Agent’.”

You could follow this principle with folders on your computer or email too. Some things may feel like they don’t fit into any of these categories, like your homebuyers report or home insurance, but as long as you remember where you put it, the system works

The original article can be found here: https://www.moneysavingexpert.com/team-blog/2020/09/10-things-we-learned-buying-a-home-in-the-coronavirus-pandemic/