Over the long-term, currency and other assets may see periods of declining value. Gold, on the other hand, has maintained its value for ages. Since ancient times, gold has been used as a way to preserve and transfer wealth from one generation to another.

Diversification that counts, because gold is stable when other assets decline

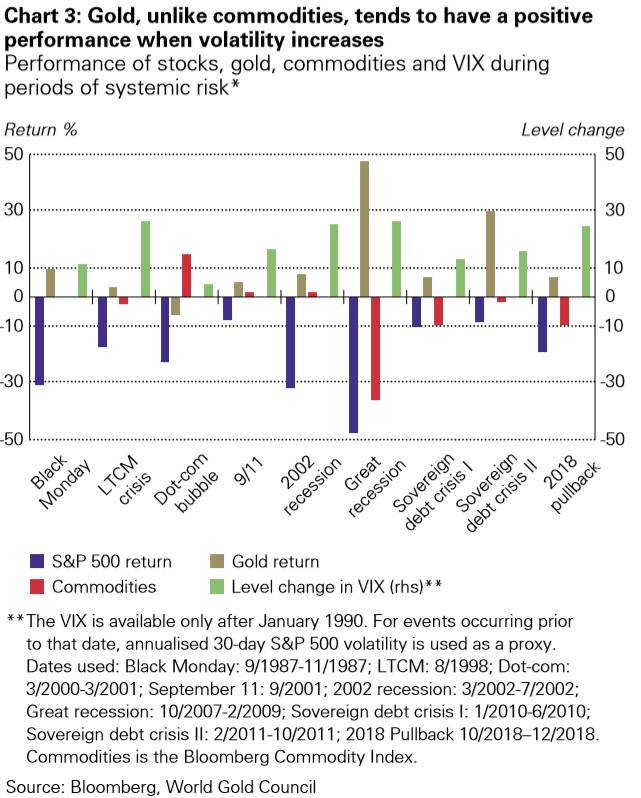

The correlation between gold and other assets, including commodities, is dynamic i.e. gold behaves differently in correlation to other assets in different economic situations. Like other commodities, gold is positively correlated to stocks during periods of economic growth; when equity markets rise, so does the price of gold. But unlike commodities, gold also performs well during times of stress to the economy, including deflation, and any other events which can negatively impact wealth or capital. Gold is seen as a crisis commodity as it tends to hold its value even during geopolitical turmoil. For example, gold prices saw a major price movement this year in response to uncertainties around Brexit.

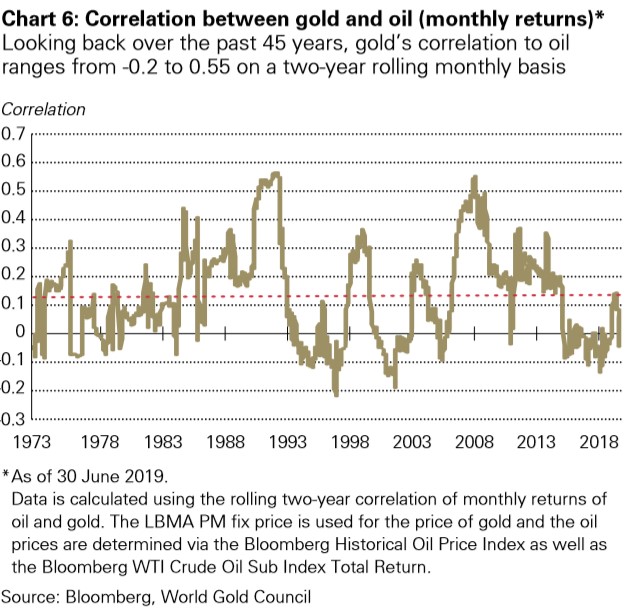

Gold and oil prices are not correlated, contrary to the popular belief- their performance sometimes moves in the same direction but at other times can be completely opposite.

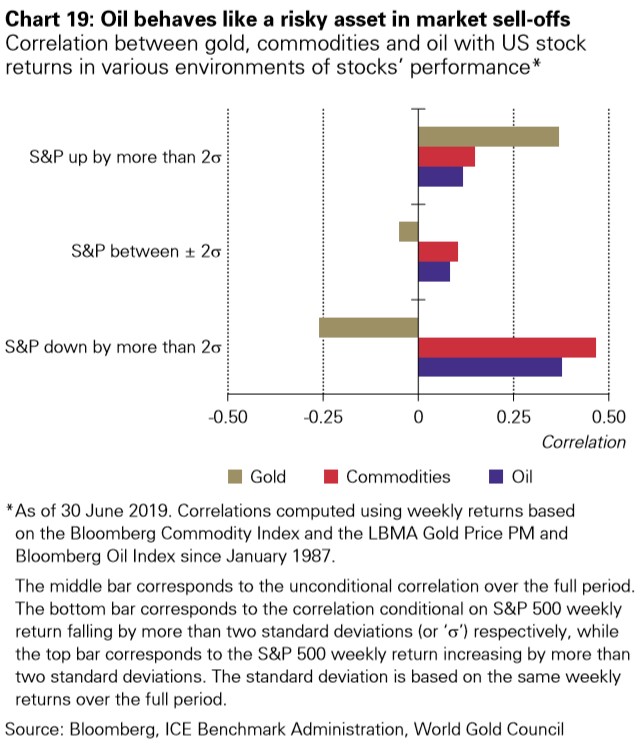

Oil tends to behave as a risky asset while gold behaves as a risk-off asset.

Oil tends to behave as a risky asset while gold behaves as a risk-off asset.

Gold as a hedge against inflation

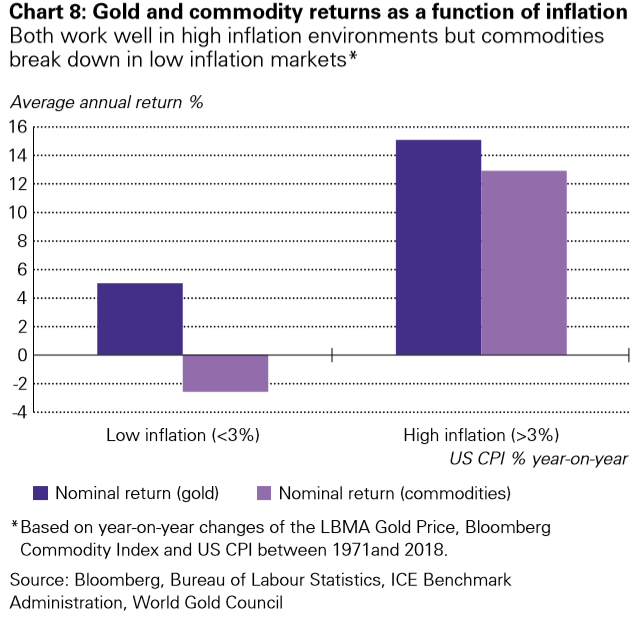

One of the most common reasons for investing in portfolios is protection against the risk of inflation, a time when commodities perform much better than other assets. But, historically, specifically in the long run, gold outperforms them all.

Economist Vivek Kaul opines that inflation is a very real risk in the times we live in. “When a government prints a lot of money, you have a large amount of money chasing the same set of goods and services, which leads to very high inflation. So, the paper money that you hold tends to become worthless over a period of time, “says Kaul, quoting the example of Zimbabwe, where inflation is at 300% as of 2019, the highest in the world. To preserve one’s wealth in such situations of volatility, Kaul suggests dedicating 10-15% of one’s portfolio to gold, in any form. Watch the video on why should you invest in gold today.

Gold supply is limited, and demand is set to rise

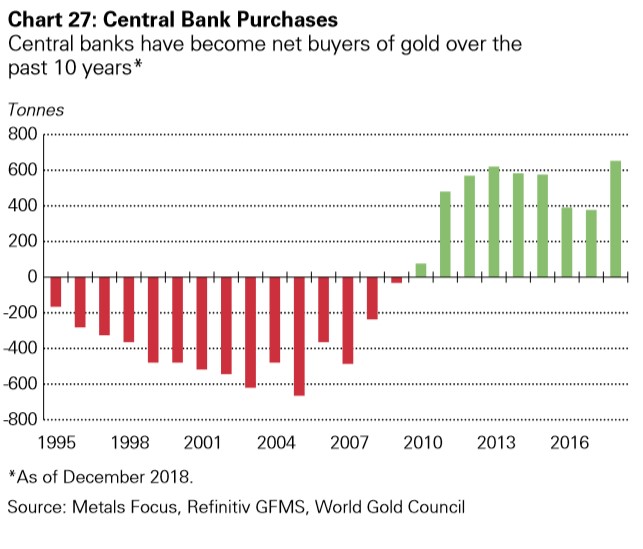

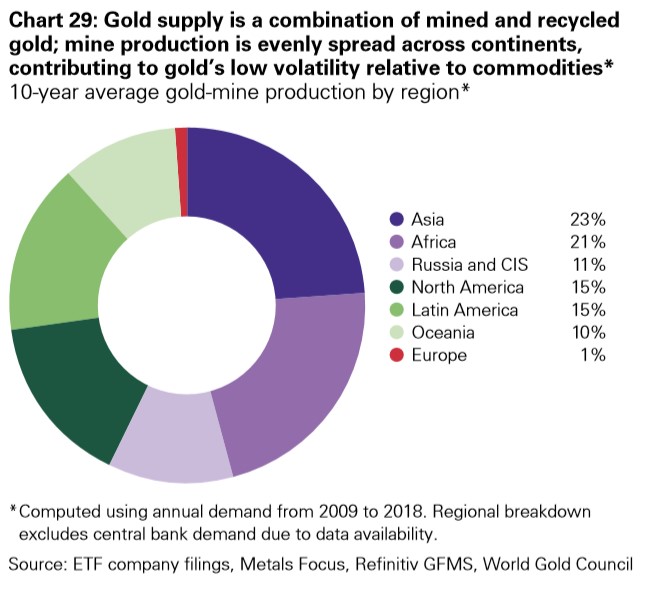

Gold is just the right amount of rare, which ensures its continuing appeal. But the market size of gold is large enough to make it a relevant investment for a wide variety of institutional investors, including central banks. Other commodities usually face supple issues in the short term due to variable production rates, but gold production is evenly distributed amongst different continents which avoid supply shocks.

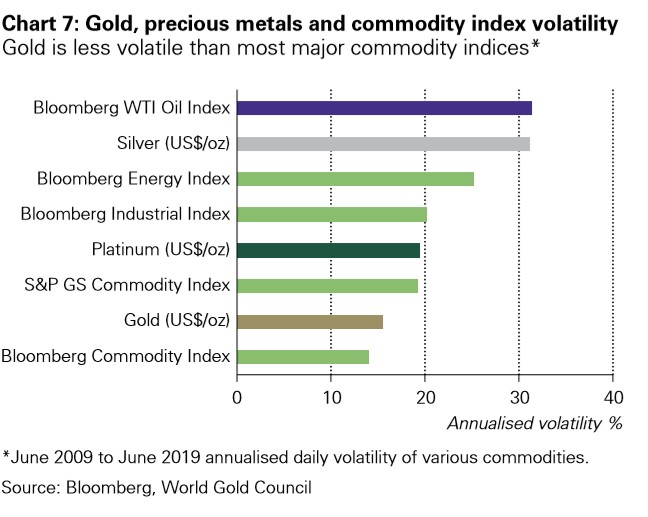

This helps to ensure that gold is much less volatile than other commodities.

The demand for gold is unshaken in a variety of economic situations. When the economy is doing well, people spend more on discretionary purchases such as jewellery and technological devices, which increases demand for gold. But even when the economy is down, when investors seek reliable, liquid assets to offset market losses, the demand for gold (and thus, its price) tends to increase.

One of the major opportunities for gold is the rapid increase in India’s middle class. The People Research on India’s Consumer Economy (PRICE) estimates that the middle class will increase from 19% of the overall Indian population in 2018 to 73% by 2048. Since gold demand increases by 1% with every 1% increase in income, it is no surprise that gold demand is set to increase.

While commodities other than gold undoubtedly have useful characteristics that make them important in portfolio diversification for both individual and institutional investors, gold has consistently outperformed these commodities due to its dynamic correlations to other commodities and assets that tend to make it a much safer investment for investors across risk profiles.

You can find the original article here: https://www.mygoldguide.in/what-makes-gold-most-useful-commodity-investment