Anyone know what’s going on yet?

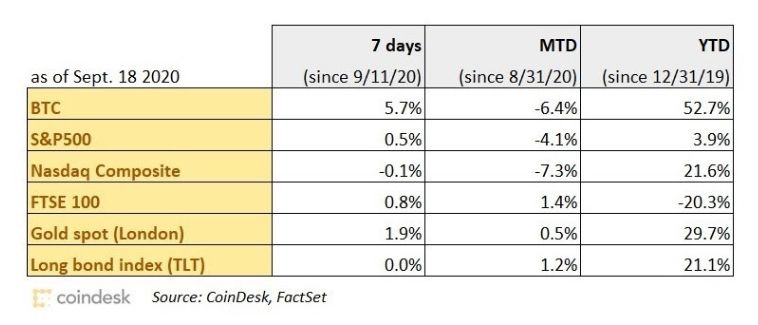

Bitcoin started to recover some ground this week, although it is still down for the month.

Stocks generally continue to languish, with the tech sector suffering a drawn-out hangover from recent exuberance. The market as a whole seemed to be feeling frustration that the U.S. Federal Reserve Chairman Jerome Powell’s remarks this week – in his last scheduled public appearance before the U.S. election – didn’t offer more clarity on inflation expectations.

Amid deepening fatigue around the persistent uncertainty (not just about inflation but also about the economic recovery, a vaccine, can our kids stay in school and so much more), concern about the fate of the U.S. dollar seems to be gathering strength. Even renowned fund manager Ray Dalio was caught hinting that “other asset classes” will pick up strength from the loss of faith in fiat currencies.

The question remains how long before this growing tension starts to really overrule the persistent faith that the Fed will keep stock markets afloat. The declines we’ve seen so far this month may hint that the concern is starting to make itself felt in the indices – or, they could just be a breather before another spurt of energy.

Be sure to listen to my colleague Nathaniel Whittemore interview Raoul Pal for a harsh take on the inefficacy of monetary policy and the need for a new economic paradigm.

CHAIN LINKS

Michael Saylor, the founder of MicroStrategy, revealed that his company has acquired an additional $175 million in bitcoin, which brings his firm’s total spend on cryptocurrency to approximately $425 million. TAKEAWAY: While it is exciting to see such public validation coming from outside our industry, it is a bit worrying when corporate treasury decisions start to be treated as publicity for a concept. It’s also disconcerting to see the resulting (or coincidental?) bump in the share price touted as a reason other corporate treasurers should put company funds into cryptocurrencies. I say this as someone who believes in bitcoin’s long-term potential (not investment advice!). I also say this as someone concerned about the pressures CFOs face in their daily jobs, and the implied assumption that putting corporate funds into bitcoin is risk-free. It isn’t.

(Nathaniel Whittemore’s interview of Michael Saylor is a compelling listen.)

Over $1 billion worth of bitcoin has been tokenized on Ethereum, equivalent to 0.42% of the total BTC supply and up from less than $7 million in January. TAKEAWAY: This is astonishing growth. The concept is compelling. It’s not just about depositing your bitcoin into a specific wallet in order to get a corresponding amount of an Ethereum-based token that you can then deposit in another wallet to get yield. It’s also fascinating for the way assets can “live” on more than one blockchain at once, even if just temporarily. We’ll no doubt be hearing a lot more about this.

Click to next page to continue reading